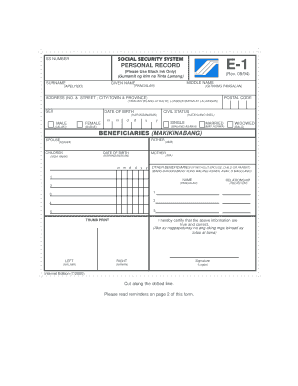

Get the free tin id form

Show details

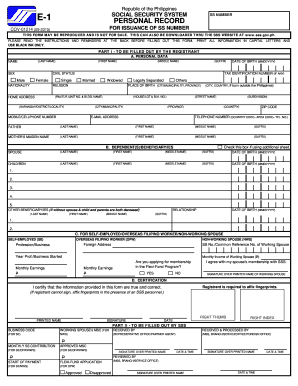

To be filled up by BIR DAN: Republican NG Filipinas Catamaran NG Pananalapi Hawaiian NG Rental Internal Application for Registration 1902 New TIN to be issued, if applicable (To be filled up by BIR)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tin form

Edit your tin number form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tin id application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tin application form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tin id registration form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tin number online registration form

How to fill out tin id online:

01

Go to the official website of the Bureau of Internal Revenue (BIR).

02

Look for the online TIN application form and click on it.

03

Fill out the required information accurately, including personal details and employment information.

04

Provide the necessary supporting documents such as a valid ID and proof of income.

05

Double-check all the information you have entered before submitting the form.

06

Wait for the confirmation or reference number provided by the BIR.

Who needs tin id online:

01

Individuals who are employed and need to comply with the tax requirements set by the government.

02

Self-employed individuals running their own businesses.

03

Students who are planning to work part-time or engage in freelance work and need to secure a TIN for taxation purposes.

04

Overseas Filipino workers who are required to have a TIN for various financial transactions and remittances.

05

Professionals who are practicing their respective fields and need to pay taxes and obtain professional tax receipts.

Fill

tin id template

: Try Risk Free

People Also Ask about tin number registration

Is TIN the same as SSN?

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

Is a TIN the same as an EIN?

The primary difference between these tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies. Therefore, the difference is in the way the EIN and tax ID numbers can be used.

Can I fill out a ITIN application online?

You can't get an ITIN number online, but you can apply for one by mail or directly at the IRS taxpayer assistance center.

How do I set up a TIN with the IRS?

To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual.

Can I fill out a w7 form online?

You can file Form W-7 with your federal income tax return. A tax return accompanied by one or more W-7 forms cannot be submitted electronically or via mail.

How do I fill out an ITIN application?

0:49 1:54 Learn How to Fill the Form W-7 Application for IRS - YouTube YouTube Start of suggested clip End of suggested clip Provide your date place of birth. And gender in boxes four and five for line six answer anyMoreProvide your date place of birth. And gender in boxes four and five for line six answer any questions that apply to your circumstances. Include any countries of citizenship foreign tanks identifiers.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample tin id to be eSigned by others?

To distribute your tin id online registration, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit tin id application on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign form for tin number. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out tin verification form on an Android device?

Use the pdfFiller mobile app to complete your tin id template editable on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tin online registration?

TIN online registration is the process of registering for a Tax Identification Number (TIN) through an online platform provided by tax authorities.

Who is required to file tin online registration?

Individuals and businesses that are required to pay taxes or conduct transactions that require tax identification need to file TIN online registration.

How to fill out tin online registration?

To fill out TIN online registration, visit the official tax authority’s website, fill in the required personal or business information, submit necessary documents, and complete any verification steps.

What is the purpose of tin online registration?

The purpose of TIN online registration is to establish a unique identifier for taxpayers, facilitating the proper administration of tax obligations and compliance.

What information must be reported on tin online registration?

The information typically required includes the applicant's name, address, date of birth, business details (if applicable), and any other identifying information necessary for tax purposes.

Fill out your tin id form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tin Id Maker is not the form you're looking for?Search for another form here.

Keywords relevant to tin form sample

Related to tin online registration

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.